TDS

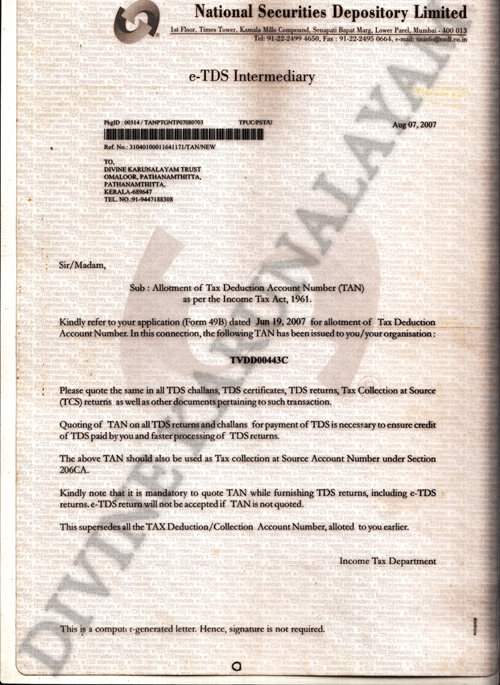

Tax Deducted at Source (TDS) is a means of

collecting income tax in India, governed under the Indian Income Tax Act of 1961. Any payment covered

under these provisions shall be paid after deducting prescribed percentage. It is managed by the

Central Board for Direct Taxes (CBDT) and is part of the Department of Revenue managed by

Indian Revenue Service (IRS). It has a great importance while conducting tax audits. Assesses is

also required to file quarterly return to CBDT. Returns states the TDS deducted & paid to government

during the Quarter to which it relates.

Tax Deducted at Source (TDS) is a means of

collecting income tax in India, governed under the Indian Income Tax Act of 1961. Any payment covered

under these provisions shall be paid after deducting prescribed percentage. It is managed by the

Central Board for Direct Taxes (CBDT) and is part of the Department of Revenue managed by

Indian Revenue Service (IRS). It has a great importance while conducting tax audits. Assesses is

also required to file quarterly return to CBDT. Returns states the TDS deducted & paid to government

during the Quarter to which it relates.